Last week we discussed the 3 primary reasons homeowners build 40x greater net worth than renters. If you missed it, here’s a quick recap:

Owners build wealth by:

- Fixing their shelter cost while rents increase year by year,

- Accumulating forced savings with monthly principal payments, and

- Leveraging appreciation by using a small down payment to benefit from the steady increase of a high value asset, their home.

(Read the full letter here)

For those of you who have been with me for a while, you’ll remember I used to talk about the

4 Factors that homeowners use to build wealth. Factor #4 was the tax benefits homeowners receive from itemized income tax deductions for their mortgage interest and property taxes.

You might ask why I no longer include tax benefits when explaining the reasons why homeowners come out ahead financially. There’s a simple explanation. The Tax Cuts and Jobs Act of 2017, also known as Trump’s Tax Cuts.

Today we’re going to dive into the changes to the tax code and see if the tax benefits of homeownership survived or if the 4th Factor is dead and gone.

Let’s quickly go through the tax deductions available only to homeowners so you can see what they are and how they work to lower your tax bill.

Mortgage interest deduction: Owners get to deduct the interest paid on their mortgage against their taxable income reducing their income taxes owed.

Property tax deduction: The tax code allows you to deduct state and local taxes. For homeowners, this includes property taxes.

You’ll soon see that the Tax Cuts and Jobs Act of 2017 changed these deductions, reducing their value to many current and prospective homeowners. For others, the benefits went away completely.

The biggest change was the reduction in the mortgage interest deduction limit. The Act dropped the limit from $1 million to $750,000 for loans taken out after December 15, 2017. This means that homeowners can only deduct mortgage interest paid on the first $750,000 of mortgage debt.

You may say, “No big deal! I was never taking out a million dollar mortgage, or even a $750,000 mortgage, so I’m not affected.” This is true for most of us as the average loan amount in the US was only $358,000 in July 2023 (per Black Knight Originations Market Monitor) but many high cost areas in the country have entry level homes starting above this threshold.

The second big change made by the Tax Cuts and Jobs Act is a cap on the state and local tax deduction. After 2017, homeowners who itemize their deductions can only deduct up to $10,000 of their state and local taxes. For top wage earners in states with high tax rates, this often means they can no longer deduct their property taxes from their income.

This increases their tax bill and eliminates one benefit homeownership had over renting.

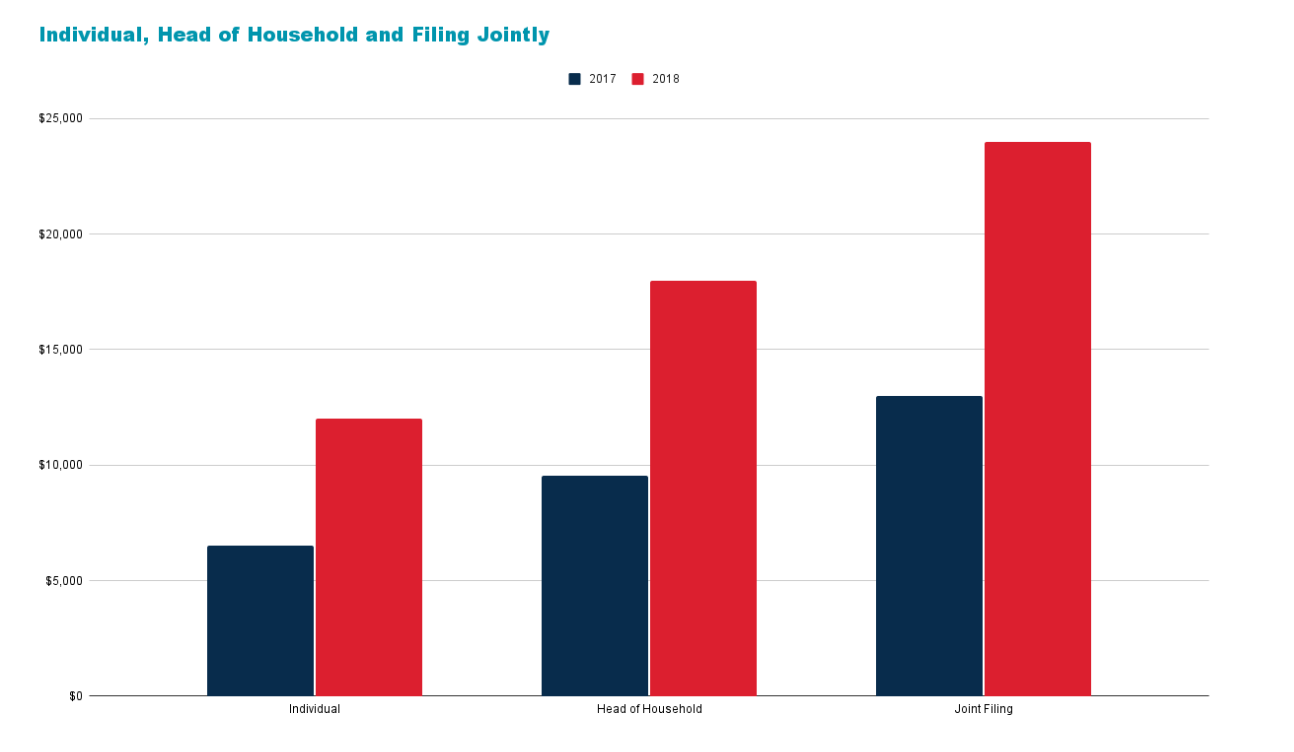

The BIGGEST change affecting the tax benefits of home ownership from the Tax Cuts and Jobs Act is actually the INCREASE in the standard deduction all taxpayers are eligible for.

An increased standard deduction reduces tax bills for everyone regardless of home ownership status. Taxes did not increase for homeowners, it’s just the relative benefit of owning is now less.

In addition, the standard deduction grows with inflation and has increased since 2018. For 2023, the standard deduction for a married couple filing jointly is $27,700. This means that many homeowners will find that they can take the standard deduction and save more money on their taxes than they would by itemizing their deductions.

Let’s look at a few examples of homeowners who would and would not see an increase to their post-tax income as a homeowner after Trump's changes:

Gabriel and Hana:

Mortgage: $700,000 - 5.5% interest rate

Combined Taxable Income: $195,000

Joint Filers

Living in Texas

0% State tax rate

State Income Tax Owed - $0

Property Taxes - $16,800 per year

Mortgage Interest Paid - $38,500

For Gabriel and Hana, the changes to the tax code aren’t all bad news. For 2023, it entitled them to a standard deduction of $27,700 as joint filers.

Since their mortgage interest exceeds that by $10,800 they will decrease their tax bill by itemizing and claiming their mortgage interest.

The bad news is their property tax deduction will be capped. The trade off for no income tax is that Texas is a high property tax state.

As a result, the $16,800 paid in property taxes exceeds the $10,000 limit for State and Local Tax (SALT) deductions. So $10k can get deducted but $6800 “goes to waste.”

The additional $20,800 deduction they can claim by itemizing will save some money come tax time. With a 22% Federal income tax rate, the increased deduction will save over $4,500 come tax time ($10,800 x 22%).

Alejandra:

Mortgage: $310,000 - 6.25% interest rate

Taxable Income: $84,000

Individual Filer

Living in Florida

0% State tax rate

State Income Tax Owed - $0

Property Taxes - $2,600 per year

Mortgage Interest Paid - $19,375

Alejandra’s calculations look a lot different from Gabriel and Hana’s. As a single woman filing as an individual, Alejandra is entitled to a much smaller standard deduction of $13,850. With her current mortgage, she will pay $19,375 in interest this year.

Living in a state with low property taxes and no state income tax is also a tremendous benefit as 100% of her property taxes are deductible as they don’t come anywhere near exceeding the $10,000 SALT deduction limit.

Adding the mortgage interest and property tax bill together gives Alejandra a total deduction of $21,975. This exceeds the standard deduction by $8125. At an effective Federal tax rate of 22%, with no state income taxes, the annual savings would be $1787.

Casey and Taylor:

Mortgage: $450,000 - 6.75% interest rate

Taxable Income: $125,000

Filing Jointly

Living in California

8% State tax rate (marginal)

State Income Tax Owed - $4,800

Property Taxes - $5,940 per year

Mortgage Interest Paid - $30,375

Casey and Taylor recently bought a $475,000 home in Lancaster, California. As joint filers, they are also entitled to the standard deduction of $27,700.

Since their mortgage interest exceeds that by $2,675, itemizing and claiming their mortgage interest will cause a small tax savings.

Unfortunately, they will not see the full benefit of the property tax deduction. Their combined income of $125k means they will owe about $4,800 in state taxes. The $5940 property tax bill will push them over the $10k limit, capping their property tax deduction at about $5200.

The good news is they will realize tax savings now that they are homeowners. The mortgage interest and property taxes will increase their deductions by $7875 versus simply taking the standard deduction.

The end result is a tax savings of about $1732 for the year ($7875 x 22% Federal and 8% California marginal tax rates). It’s not a ton, but it’s real money that reduces the net cost of ownership.

Finally, let’s look at a scenario where buying a home will present

NO tax savings.

Matthew and Tiana:

Mortgage: $200,000 - 7.00% interest rate

Taxable Income: $78,000

Filing Jointly

Living in Kansas

5.25% State tax rate (marginal)

State Income Tax Owed - $4,095

Property Taxes - $3,500 per year

Mortgage Interest Paid - $14,000

For Matthew and Tiana, the calculation is simple. With $14,000 of interest and $3500 or property taxes, they would be better off taking the $27,700 standard deduction for joint filers since it exceeds their itemized housing deductions total of $17,500.

The only way itemizing would make sense, and present a tax savings, would be if they had additional itemized deductions besides mortgage interest and property taxes that exceeded the standard deduction. This is highly unlikely.

The bottom line is the buyers most likely to see no tax savings from home ownership are joint filers in low cost of living areas that are able to buy with smaller mortgages.

Each of the other 3 scenarios still result in tax benefits to the new homeowners but the savings are much less than they would have been prior to the tax changes.

For most people, it’s probably safe to look at tax savings as a nice potential bonus instead of a major benefit.

Remember, these are just a few examples. The specific benefits you qualify for will depend on your individual circumstances.

If you are unsure whether you will see a tax benefit from buying a home and itemizing your deductions, consult with a tax advisor.

I hope this letter has been helpful in explaining the tax benefits of home ownership. If you have questions, please reach out. We’re here to help!

Looking forward,

Josh